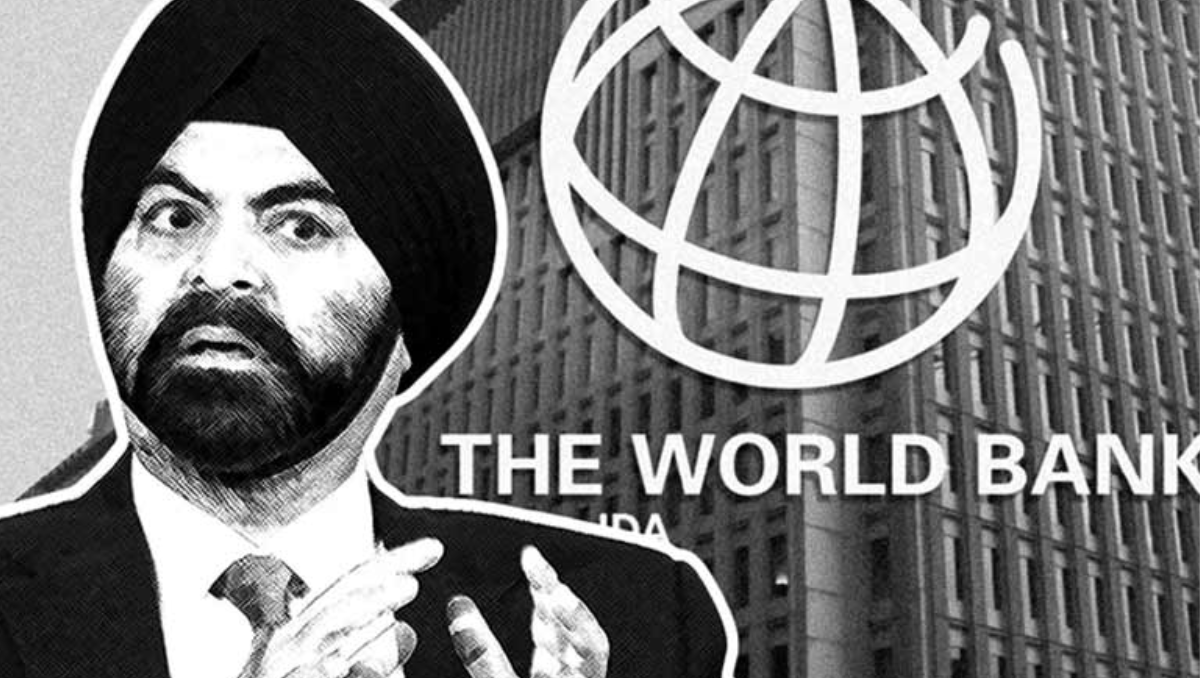

Ajay Banga, the president of the World Bank in a conference highlighted the fact that the conflict does not only cause humanitarian tragedy but also has economic repercussions that the world cannot afford

Apart from violation of human rights, and international laws, damage to property and life. The secondary implications of the conflict are on Global economies, interest rates, stock markets, Trade, and investment

Conflict hinders the Central Bank’s effort to achieve a soft landing

Ajay Banga pointed out that if the conflict continues or escalates into a war then it will have far-reaching consequences, he fears that the conflict will hinder the Central Bank’s effort to achieve a soft landing in various economies.

Image Source – Mint

He is afraid that the ongoing situation will make it more challenging for Central banks to maintain stability in different economies. He highlighted the unwanted destruction and long-lasting impact that the conflict will have on the global economies.

The president said that though the impact of this conflict on economies was not immediate as compared to Russia’s invasion of Ukraine last year, the Israel-Gaza conflict does not impact exports of oil, grains, and fertilizers but still some effects are transmitted through financial markets, He noted that in the recent month, there were positive signs of improvement like inflation was decreasing, the prices and wages were stabilizing, the market was adjusted to the idea of higher interest rates but this conflict upset the positive developments and dynamics of the global economic scenario.

Image Source – ABP news

The interest rate will be higher for a couple of years

He told the conference that the interest rate would be higher for a long period and this would bring complications in investments across the world as well as to the people who got used to a low investment rate environment, this would affect trade flow and investments globally

Already existing inflation and now this conflict has made the central banks keep their monetary policy rate higher than it was anticipated. This makes it difficult for borrowers to repay the debt and for the bank to make bigger Investments, High interest rate hampers private investments as borrowing become more expensive

The Major problem is that growth is decelerating to a much lower level than we had seen during the past crisis. The World Bank expect that the interest rate will be higher for the next few years and countries with high bilateral or multilateral debt will be facing challenges including bankrupting

Image Source – The Indian Express

Under the leadership of Ajay Banga, The World Bank is focusing on addressing the triple challenges of pandemic, climate change and food insecurity. In the end, he expressed his concern over the ongoing violence however he did not dwell on politics but emphasized the importance of offering support to the affected areas and providing conflict subsidies